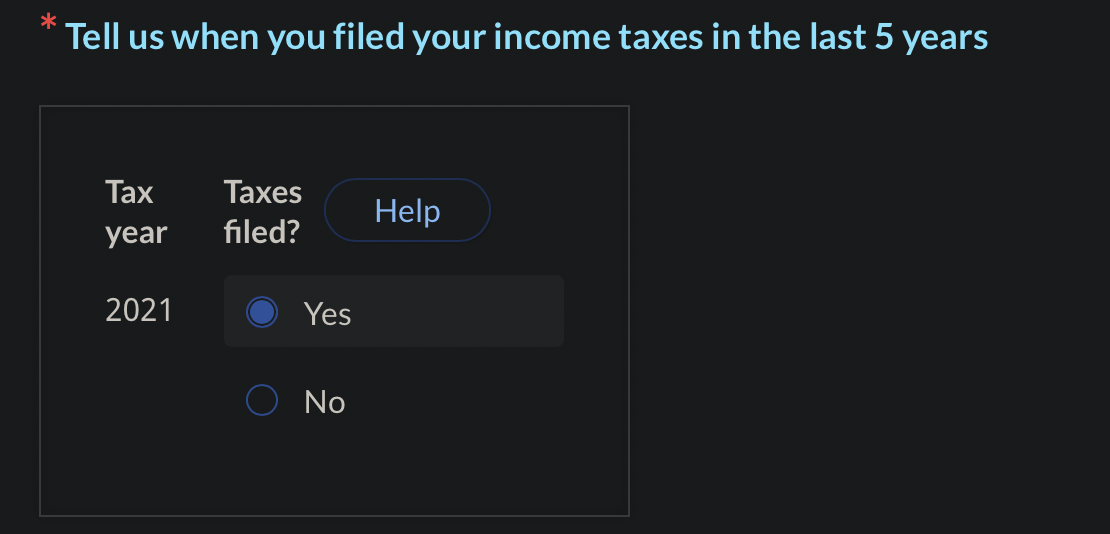

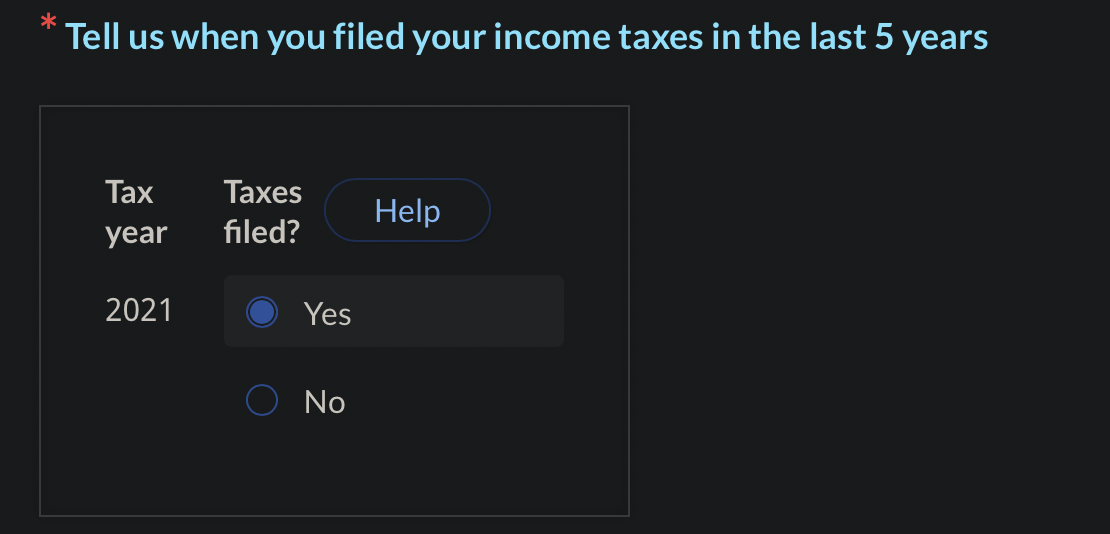

Hey guys, I’m about to submit my application for citizenship, but I realized that I have not filed tax for 2021 yet (my T4 has not arrived). So should I choose yes or no for this? Will there be back effect if I choose no? I normally file my tax in March or April, I’m confident the tax will be filed before my application is completed

Basically, the fact is I have not filed my tax for 2021 yet. But if I choose “no”, it feels like I’m sending a false signal to immigration officers saying “I don’t plan to file my tax this year”, plus I will file my tax before my application is done. I’m struggling about which one should I choose

Basically, the fact is I have not filed my tax for 2021 yet. But if I choose “no”, it feels like I’m sending a false signal to immigration officers saying “I don’t plan to file my tax this year”, plus I will file my tax before my application is done. I’m struggling about which one should I choose

Last edited: