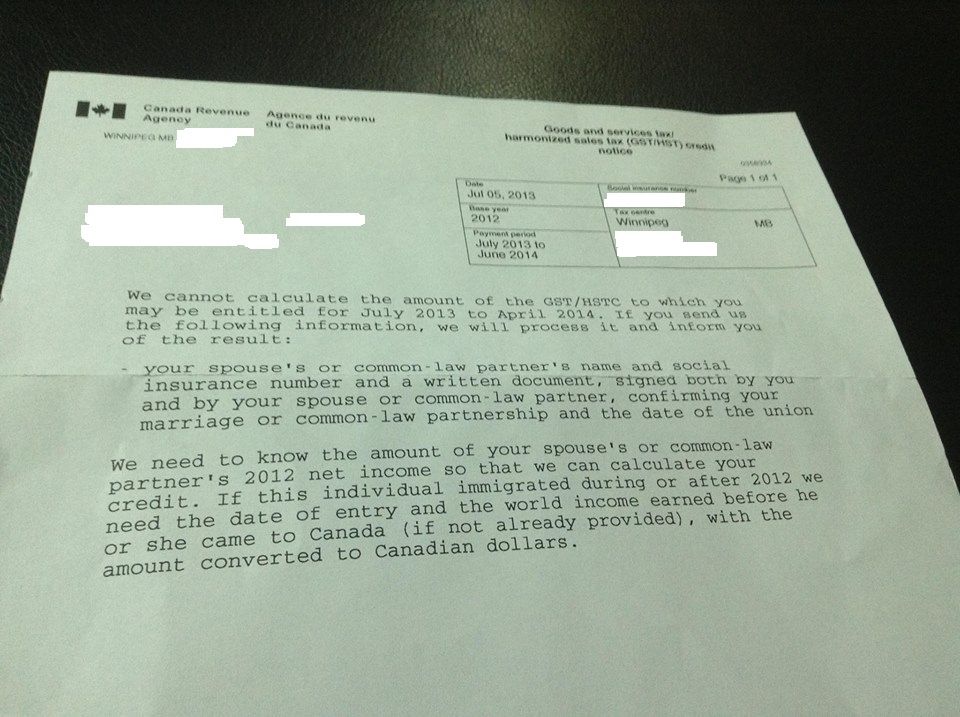

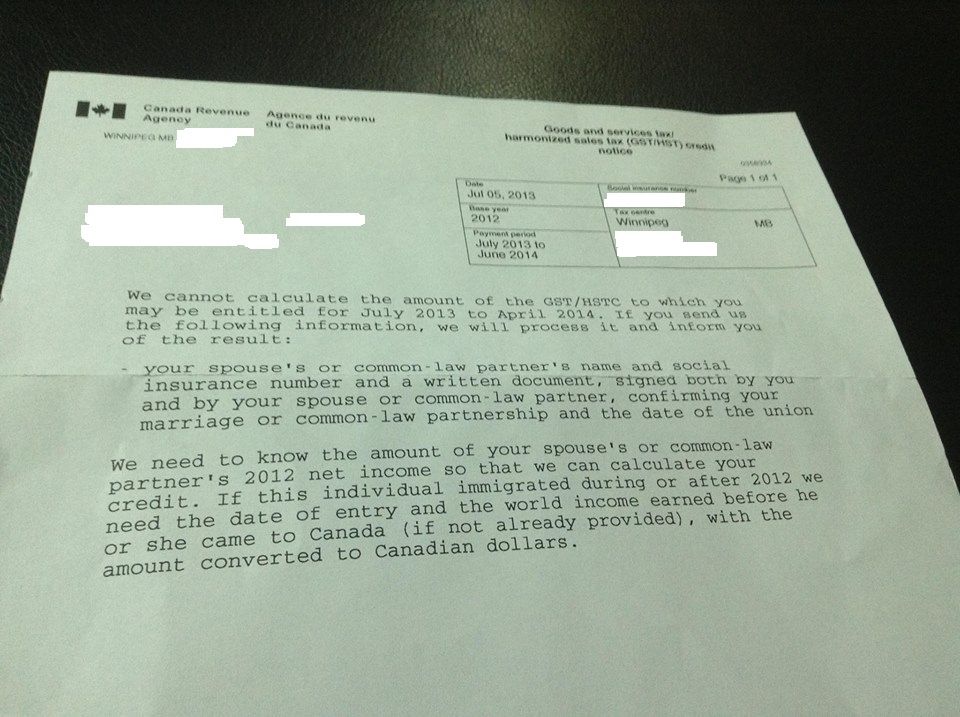

I received one of those very same letters myself this week, that is for calculating GST credits and such. Mine asks for a signed letter from myself and my wife, along with a statement saying how much money she earned etc. as well as a copy of our marriage certificate etc.

I plan to write them back and explain our situation (still waiting for CIC etc). They already have all of this information from when I filed earlier this year, but government offices being what they are, communications between them is generally lacking. So I plan to write them back, and see if a statement from me is fine along with proof of marriage etc. and let them know, that if they want something in writing from her, then that will take a few weeks.